Starting a business is a rush. You’ve got the idea, the drive, and maybe even some early wins under your belt. But somewhere between launching your product and growing your team, one critical thing often gets pushed aside: your financial foundation. And financial chaos is the fastest way to kill the startup high.

It’s not just a hunch—82% of small businesses fail due to cash flow problems (U.S. Chamber of Commerce). Another 38% shut down from poor budgeting and financial oversight (Eximius Ventures). That’s a steep price to pay for avoidable mistakes.

We see it all the time. Founders are focused on building—creating a great product, closing sales, and attracting customers. But that momentum can grind to a halt if the numbers aren’t adding up behind the scenes.

At LGA, we work with startups at every stage, and the pattern is clear: the earlier you bring in financial expertise, the better your odds of success. Whether it’s a full-time CFO or a fractional one, having someone focused on financial strategy can help you avoid costly mistakes that derail even the best ideas.

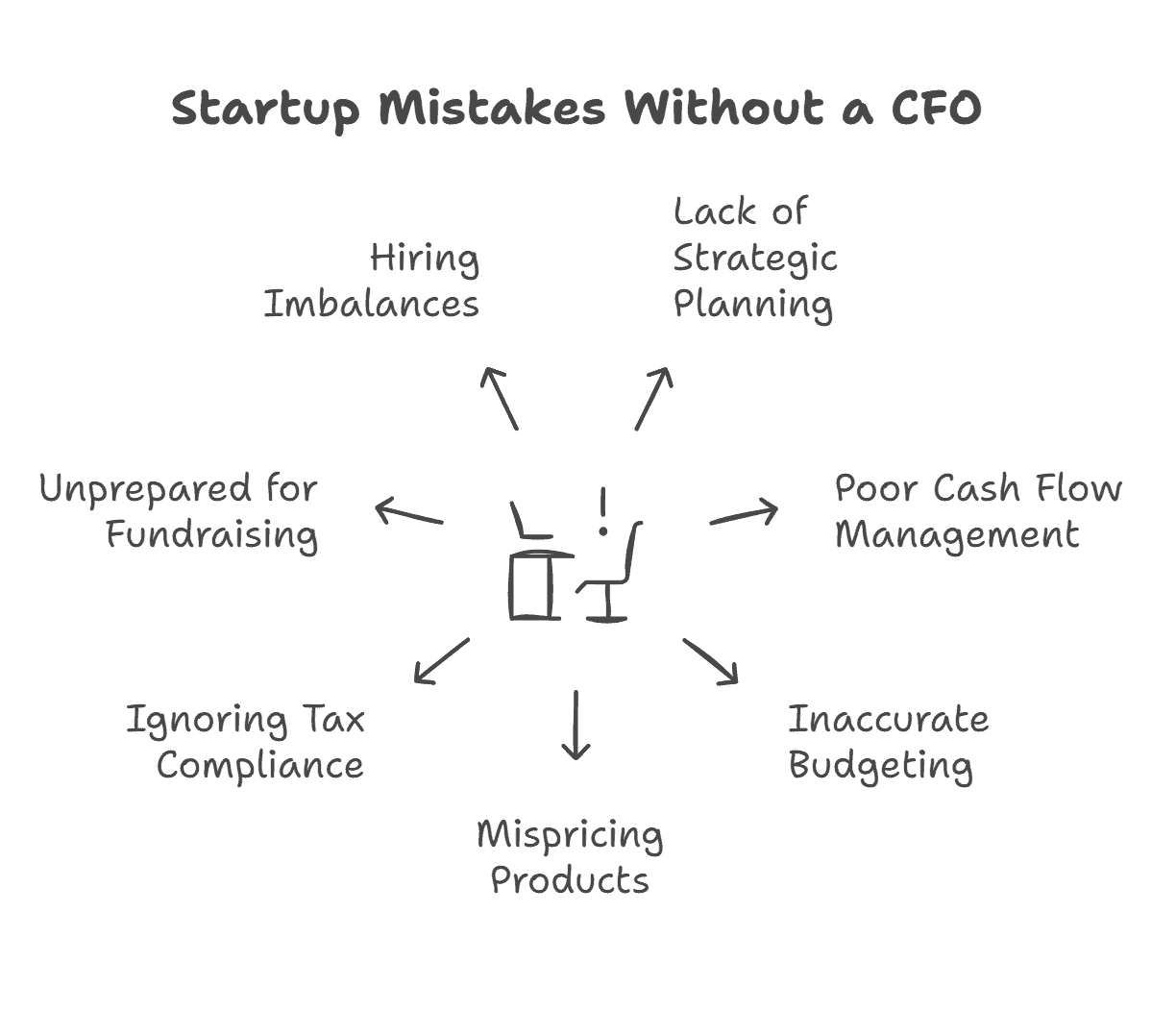

Most Common Financial Pitfalls

Let’s walk through the most common financial pitfalls we see—and how having a CFO can help you avoid them.

A lot of startups fly blind when it comes to long-term financial planning. They operate month-to-month without a clear roadmap for growth, profitability, or cash needs. That’s risky business. A CFO can help develop a thoughtful strategic financial plan that aligns with your goals, identifies inflection points, and helps you prepare for both growth and setbacks.

2. Poor Cash Flow Management

Cash flow issues are the number one reason startups fail. It’s not just about how much revenue you’re generating—it’s about when cash is coming in and going out. A CFO builds cash flow models, evaluates burn rate, and helps you prioritize spending, so you don’t run out of runway.

3. No Real Budget—or Overspending Based on Guesswork

We’ve seen plenty of startups build budgets on pure optimism. Sales projections are inflated. Expenses are underestimated. There’s no buffer for the unexpected.

Also, you can’t manage what you don’t measure. Basic bookkeeping, a thoughtful chart of accounts, forecasting and analysis, financial reporting, and accounting software can provide valuable insights. Consider using accounting software or hiring a part-time bookkeeper to keep things organized.

4. Mispricing Products or Services

Pricing is tricky, especially when you’re trying to compete or scale quickly. Set prices too high, and you scare off customers. Too low, and you bleed money. CFOs can analyze your cost structure, margins, and market conditions to set pricing that’s both competitive and profitable.

5. Ignoring Tax and Compliance Requirements

Deadlines get missed. Contractors are misclassified. Filings are late. Cross-state employment and Nexus are overlooked. These mistakes cost money—and investor confidence. A CFO keeps you compliant from the beginning. They work with tax advisors to make sure you don’t overlook critical requirements that can lead to penalties or legal exposure.

6. Not Preparing for Fundraising

You’ve got a pitch deck and a dream, but if your financials aren’t in order, investors will walk. A CFO helps build investor-ready models, clean up your cap table, and answer the hard financial questions that come up during due diligence. Startups with clear, defensible numbers earn more trust—and usually better valuations.

7. Hiring Too Fast (or Not at All)

It’s easy to get excited and start hiring quickly, but are you making the right hires at the right time? Or worse, are you delaying hires and burning out your core team? A CFO evaluates your team structure, forecasts future costs, and helps ensure you’re scaling your team responsibly.

The Bottom Line: Don’t Wait for a Financial Fire Drill

Don’t wait until something breaks to get help with your finances. By then, fixing it is harder—and more expensive.

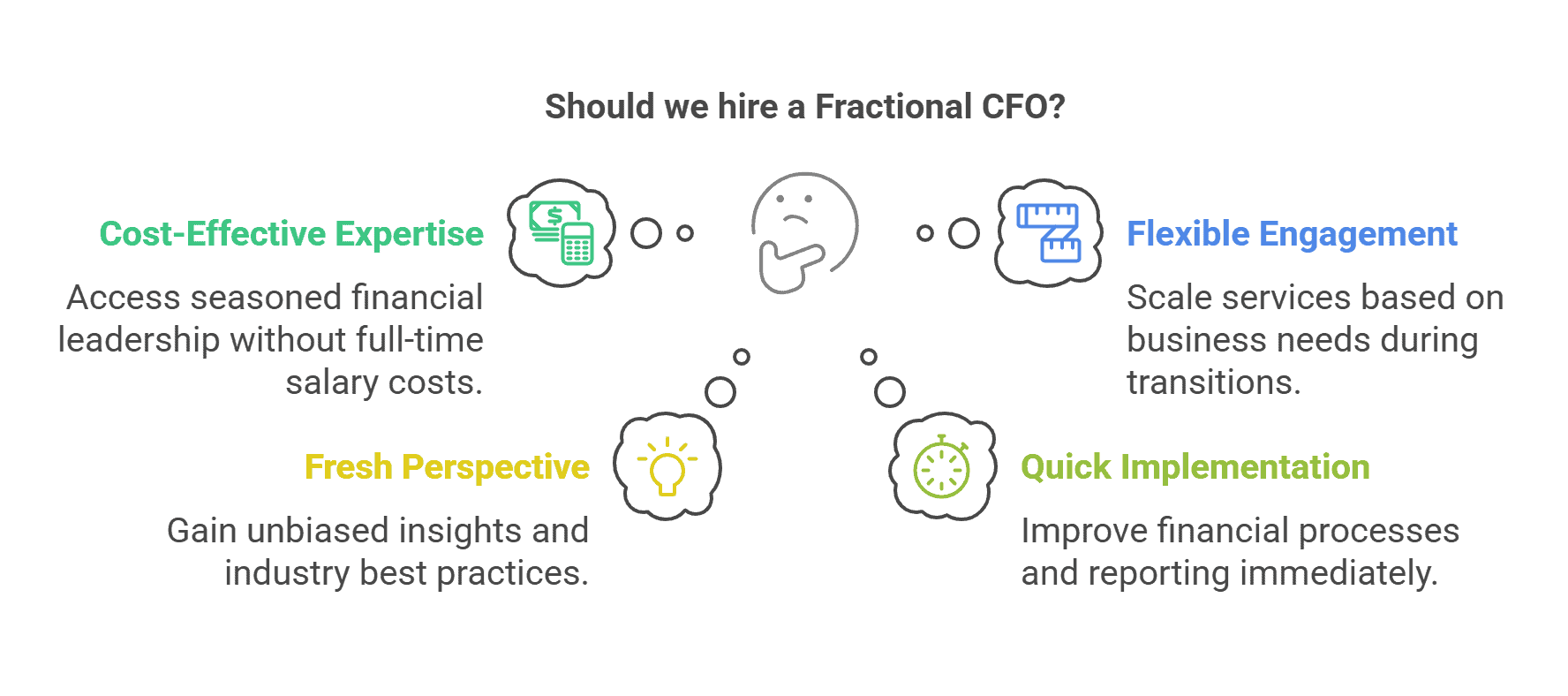

The good news? You don’t need to hire a full-time CFO right away. Fractional CFO services are an affordable, flexible way to get the guidance you need without the full-time cost. You get high-level insight, financial structure, and peace of mind.

Need Support Getting Your Financial House in Order?

At LGA, we help startups build strong financial foundations—from outsourced CFO services to tax strategy and compliance.

Let’s talk about how we can help you scale smarter—and avoid becoming a statistic.