If you make a change in vehicle during the calendar year 2019, a recent IRS update may affect you at tax time. On May 21st, the IRS released Revenue Procedure 2019-26. It includes depreciation deduction limitations for owners of vehicles that are first put into service in 2019. These figures are updated annually. The new deduction amounts are calculated using chained CPI to reflect inflation, in accordance with the Tax Cut and Jobs Act.

This revenue procedure affects owners and lessees of new passenger automobiles, including vans and trucks. A vehicle doesn’t have to be purchased new to qualify; it must only be new to the taxpayer in 2019. New owners of used vehicles may be eligible for the depreciation deduction if the purchase meets the acquisition requirements of § 168(k)(2)(E)(ii).

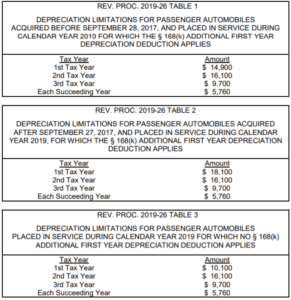

Table 1 provides the depreciation limits for vehicles purchased before September 28, 2017 and placed in service in 2019. For these vehicles, the first-tax-year depreciation limit is $14,900 under Sec. 280F(d)(7). Table 2 provides the depreciation limits for automobiles acquired after September 27, 2017 and placed in service during 2019. For these vehicles, the first-tax-year depreciation limit is $18,100 under Sec. 280F(d)(7).

Table 3 provides the depreciation limit for automobiles placed in service during 2019 for which no additional first-year depreciation deduction applies. This table is relevant for taxpayers who use their vehicles for less than 50% business purposes, or those who buy used vehicles that don’t satisfy the acquisition requirements. The first-tax-year depreciation limit is $10,100.

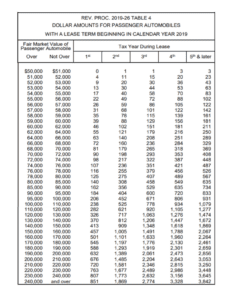

The revenue procedure also includes Table 4, relevant to some taxpayers who begin new leases on passenger automobiles during 2019. In accordance with § 1.280F-7(a), these taxpayers must refer to this table for updated income inclusion amounts. They’re based on the fair market value of the leased automobile.

If you have questions related to this revenue procedure, contact Steve Gallant.