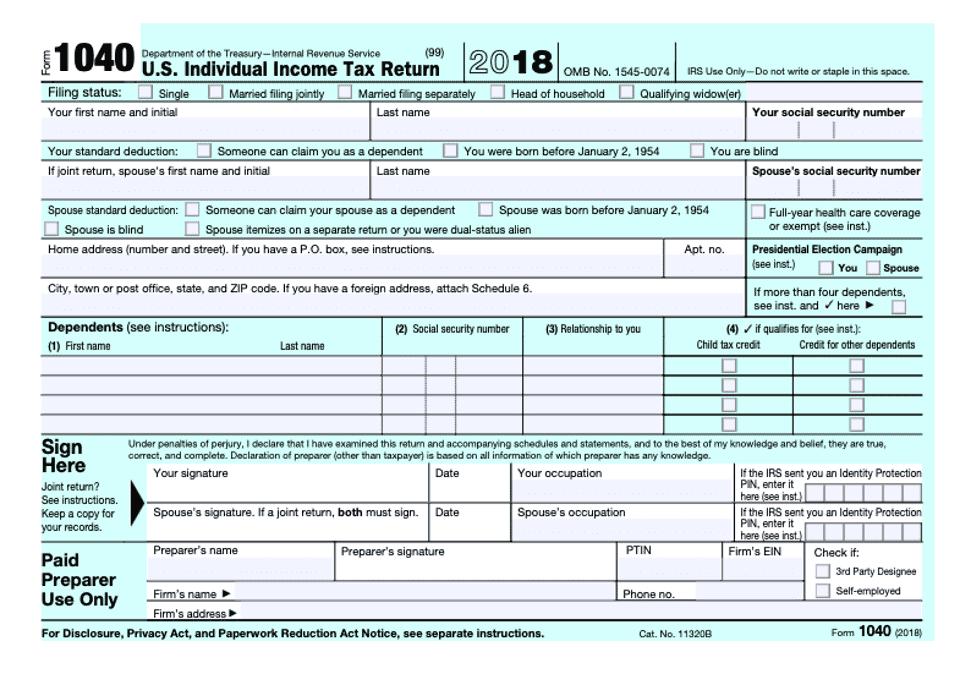

When you receive your individual tax return from us, the forms may look more unfamiliar than usual. There’s a good reason for that. The IRS has revamped the 1040 form to be smaller and post-card shaped. The form is now two half pages and six supporting schedules – named Schedule 1 through Schedule 6 – which replace the old form’s pages 1 and 2.

Here’s page one:

In addition to replacing the Form 1040, these forms also replace the 1040A and 1040EZ. The idea is that you only complete the schedules that apply to you.

These are the schedules:

- Schedule 1 for additional income including capital gains, unemployment, and gambling or deductions including student loan interest, self-employment tax and educator expenses

- Schedule 2 for AMT and excess advance premium tax credit repayment

- Schedule 3 for nonrefundable credits, except child/dependent tax credits, including the foreign tax credit, general business credits and education credits

- Schedule 4 for other taxes such as household employment taxes, self-employment taxes, and additional taxes on retirement plan distributions

- Schedule 5 for certain refundable credits such as advance premium tax credit or have additional tax payments such as extension payments or excess social security withholding

- Schedule 6 for designation of third-party representative or filing using a foreign address

If you have any questions about the new forms, please contact Larry Andler or Marci Cohen.

Written by Larry Andler