“Succession planning,” the words themselves can feel heavy, loaded with implications about the end of an era. But what if we shifted our perspective? What if we looked at succession not as walking away, but as evolving? As a continuation of a legacy, a careful passing of the torch that honors the original mission while paving the way for future growth?

When business owners are asked about succession planning, the conversation often goes beyond numbers and spreadsheets. We see the emotional weight, the deep connection business owners have with what they’ve built. It’s not just an asset; it’s a part of their identity, their life’s work.

So, let’s talk about succession planning in a way that acknowledges that heart and soul.

Where to Begin: Clarity and Heart

The first question we often hear is, “Where do I even start?” Especially when the business feels like an extension of yourself, that question can be overwhelming.

From my experience, there are usually two paths to succession: the expected and the unexpected. The expected path might be a family member already involved in the business. The unexpected? It could be someone from within the company who isn’t a family member, or even an external buyer who aligns with your values and vision.

Start with clarity. But not just financial clarity. Start with personal clarity. Ask yourself:

- What do I want my role to look like in 3 to 5 years?

- Do I want to stay involved, perhaps in an advisory capacity, or do I envision fully stepping away?

- What will I do to fill my days after selling my business?

It’s about understanding your desires and aligning them with your business’s future. From there, we can map out a timeline and explore options, whether it’s identifying internal successors or considering external buyers. It all begins with you.

The “Soul” Questions: Mission and Story

How do you ensure the next generation understands the heart of the business? Embed your values into how you train and mentor your successors. Share the “why” behind your decisions. Some founders even write a letter or record a message to explain the spirit of the business.

Storytelling plays a huge role. When your team and clients know the story of why the business was started and what it stands for, they are more likely to support the transition.

Protecting the Soul: Culture and Values

One of the biggest concerns we hear is about protecting the company culture and its people. But culture isn’t just written down; it’s lived.

When it comes to succession planning and business valuation, however, company culture can have a significant, often underestimated impact on how a business is valued by buyers or successors. Here’s a breakdown of why and how.

- Culture Reduces Key-Person Risk: If the business relies heavily on the founder’s relationships or leadership style and the culture hasn’t been institutionalized, buyers will see this as a risk and likely lower the valuation.

- A Strong Culture Supports Continuity: A well-defined, embedded culture signals to potential buyers or successors that the team can operate successfully without daily direction from the founder. This increases buyer confidence and perceived stability, both of which enhance valuation.

- Culture Drives Retention — and Retention Drives Value: High employee engagement and low turnover mean that buyers don’t have to worry about the expense of rehiring or retraining. Businesses with engaged teams and long-tenured employees are more attractive because they reduce post-acquisition disruption.

- Culture Can Be a Competitive Advantage: If your culture fosters innovation, customer service excellence, or operational efficiency, those are value-driving intangibles. Buyers often assign a premium to companies with a positive brand reputation, which is often rooted in internal culture.

- Culture Impacts Transition Success: Buyers want to know that the team will stick around and perform under new leadership. A positive, values-driven culture helps smooth that transition and reassures investors or acquiring companies.

Tangible Ways Culture Shows Up in Valuation

- Employee retention rates

- Customer satisfaction and churn data

- Training, development, and documented SOPs

- Leadership pipeline health

- Internal survey results (engagement scores, Glassdoor reviews)

These cultural indicators don’t always appear in a traditional valuation model, but savvy buyers and M&A teams are increasingly requesting them.

Key Takeaway: You can have the cleanest books and strongest margins in the world, but if your culture is toxic or founder-dependent, it’ll show up as a red flag in diligence. Culture isn’t fluff; it’s an asset or a liability.

Avoiding Pitfalls: Time and Communication

The most common mistake we see is waiting too long.

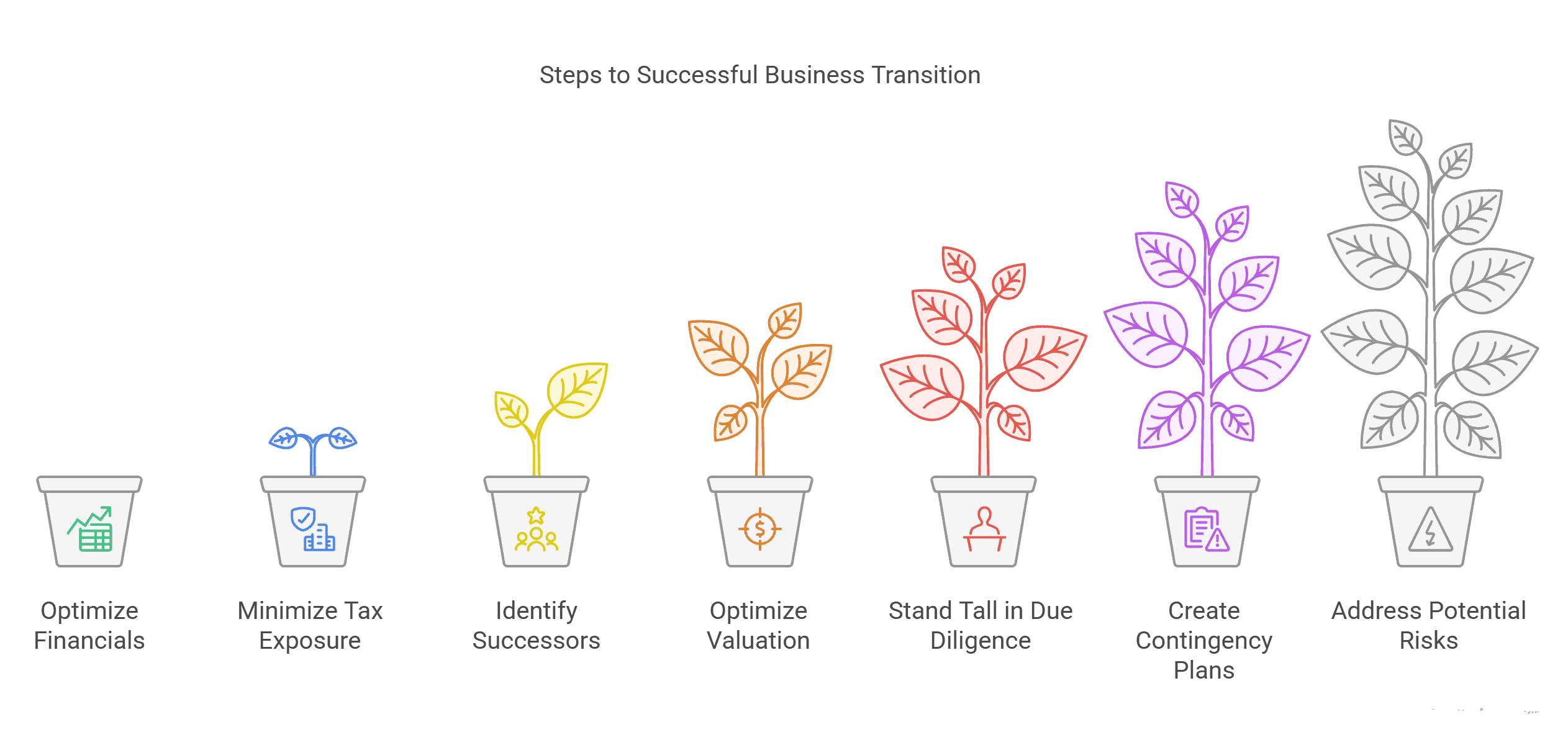

Succession planning takes time — years, not months. It’s also about more than taxes. Neglecting to groom internal leaders, failing to communicate with staff, or letting financial and tax considerations dictate every decision are common pitfalls. A balanced plan considers leadership development, financial strategies, and clear, open communication.

Ideally, succession planning should start 3 to 5 years before you plan to transition. This allows ample time to:

Another factor is identifying what you need, financially, to sell the company. We recommend consulting with your wealth manager to determine the dollar amount you need, after taxes, to meet your financial and life goals.

Keeping Everyone Engaged: Transparency and Trust

Keeping long-term employees and stakeholders engaged during this process is essential, and transparency is key. Involving them early, especially key personnel, reassures them. But telling them too soon could cause anxiety. People fear the unknown.

To keep key employees engaged, consider incentive plans, stock options, or retention bonuses to provide stability and to show appreciation for their commitment.

More Than a Financial Transaction — It’s a Legacy

Succession planning is about more than finances and legal documents. It’s a deeply personal journey — one that honors the legacy, values, and relationships you’ve built over a lifetime. It’s not about walking away; it’s about evolving and about ensuring that what you’ve created continues to thrive with purpose and intention.

If you’re beginning to think about the future of your business, let’s start the conversation. I’m here to help you navigate every step of the process with clarity, compassion, and a strategy that respects both the numbers and the heart behind them.

Schedule a call with me, Ken Segal, and let’s explore what your next chapter could look like — together.