Divorce & Business Valuations: Insights from Business Valuation Professionals

The valuation process can be complex in divorce proceedings involving business assets. Valuing a business in the context of divorce requires careful consideration of unique factors like company-specific risks, historical financial performance, officer compensation, and discretionary expenses. Additionally, understanding on how to project future earnings while adjusting for normalization factors is also essential.

Business valuation professionals are often called upon to help navigate these waters, ensuring an unbiased valuation that reflects a business’ true worth.

This article explores some of the most critical questions that arise during divorce-related business valuations, offering insights into the decision-making process and key considerations that impact the final valuation.

Years to Analyze

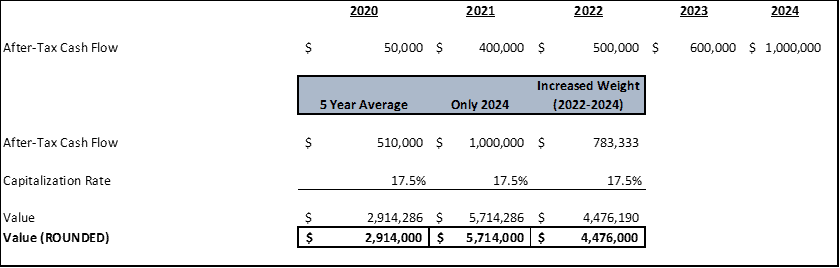

Reviewing historical financial information is perhaps the most useful exercise in determining a company’s value (typically the past five years are analyzed at a minimum). While historical performance doesn’t necessarily dictate what will happen in the future, it gives the valuator an idea of the company’s revenue and expense structure. Calculating a company’s value based on one highly profitable or low earning year may be misleading, the professional must consider a sustainable earning stream and risks associated with achieving same. Determining reasonable ongoing cash flow is the basis for calculating value. This might mean taking an average of the past five years, just using the most recent one or two years, or factoring in all of the years and giving the recent years the most weight. The company specific factors are ultimately most important when considering weightings.

Below is an example showing yearly after-tax income from 2020-2024 and the resulting values using a five-year average, just using the most recent year (2024) and weighting the last three years giving more weighting to the more recent years:

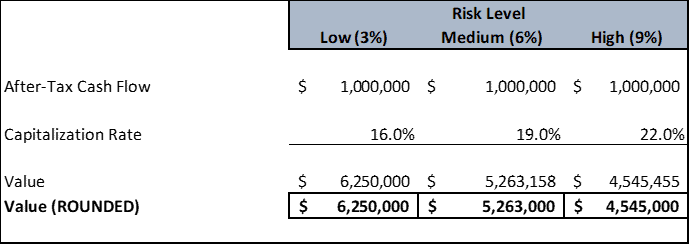

Company-Specific Risk

When assessing a company’s risk, identifying and quantifying the following factors, among others, play an integral role in determining the overall value: the length of time a company has been in business; the concentration of its customer base and length of time with clients; industry regulations specific to the company that may not be relevant to the macro industry; vendor relationships, including for sourcing goods and also complimentary relationships such as banking and insurance providers; and, the experience and reputation of the owner. Generally speaking, a company with recurring revenue and without significant customer concentration suggests less risk than a company without recurring revenue and a few customers that make up a large portion of revenue. Each business, even in the same industry, operates differently and the risks need to be considered on a case-by-case situation.

Below is an example showing values using company-specific risk factors of 3% (low), 6% (medium) and 9% (high):

Officer Compensation

Officer compensation can often be a point of contention in valuations for divorce purposes. In smaller closely-held companies, the owner may be able to pay themselves as little or as much as they want. As part of the valuation process, reasonable officer compensation is often considered. Reasonable compensation is determined using third-party data based on the industry, size of the company, owner’s experience level as well as other company specific metrics; in some cases, a third-party compensation expert may be involved. The valuation professional should tailor the analysis to the officer’s education, experience, career history, relationships, roles, responsibilities, and hours worked, among other factors. In calculating cash flow, there is an inverse relationship between officer compensation and business value. The higher the officer compensation, the lower the business value (and the lower the officer compensation, the higher the business value).

If alimony and child support are to be determined, officer compensation plays an important role. Higher officer compensation means a lower business value (and higher support). Lower officer compensation means a higher business value (and lower support).

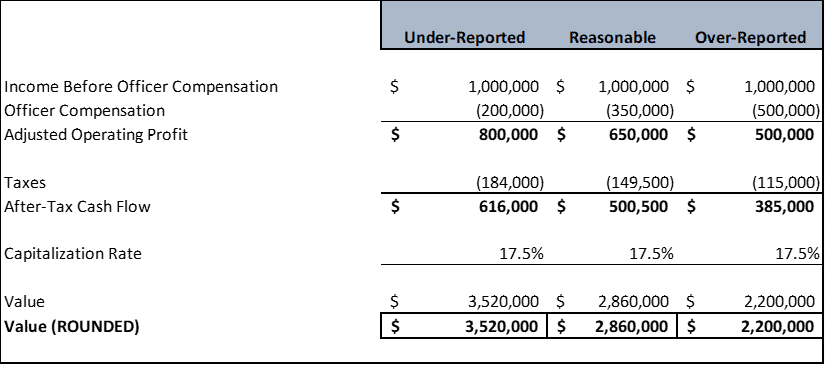

Below is a calculation that shows the value of a company with officer compensation at three different levels (under-reported, reasonable and over-reported):

Projections

Projections can play a significant role in valuing a business for divorce purposes. However, they must be realistic and based on sound reasoning. Historical company growth, industry forecasts, and other factors could influence future performance. In some cases, projections provided by the business owner might be overly optimistic or pessimistic, so the analyst needs to make adjustments or provide sensitivity analysis for multiple scenarios.

Situations where projections might be used to determine ongoing cash flow would be:

- Short operating history

- Significant new customer not included in historical financials

- Loss of significant customer

- Loss of vendor or supplier

- Significant increase or decrease in operating costs

It is important to consider the specific risks in the company’s earnings potential when projections are utilized. This may result in an upward or downward adjustment to the company’s company specific risk.

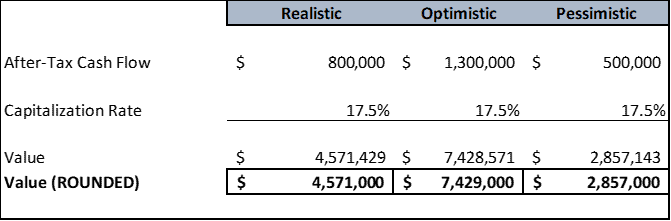

Below is an example that shows projections at realistic, optimistic and pessimistic levels. Each level assumed the same capitalization rate (and company-specific risk). As you can see, there are significant variations in value if the company-specific risk is not adjusted based on different levels of projected earnings:

Discretionary Expenses

Discretionary expenses often come under scrutiny in divorce-related valuations and may require forensic investigation. But how do you distinguish between necessary and discretionary expenses? And how do you adjust for personal expenses disguised as business costs?

Discretionary expenses like travel, meals, or personal vehicle costs can artificially inflate the company’s cost structure. Closely examining expenses and thoroughly reviewing the financial statements is crucial to identifying personal or non-business-related items that could be added to the owner’s income or business cash flow. Typical non-business or discretionary expenses that are added back to income are:

- Luxury vehicle costs

- Attorney’s fees related to the divorce

- Payroll for family members in excess of fair market value

- Excessive travel or meals

- Benefits that are paid on behalf of an owner and not for other employees

- Rent expense in excess of fair market value (if the office building is owned by the owner of the business)

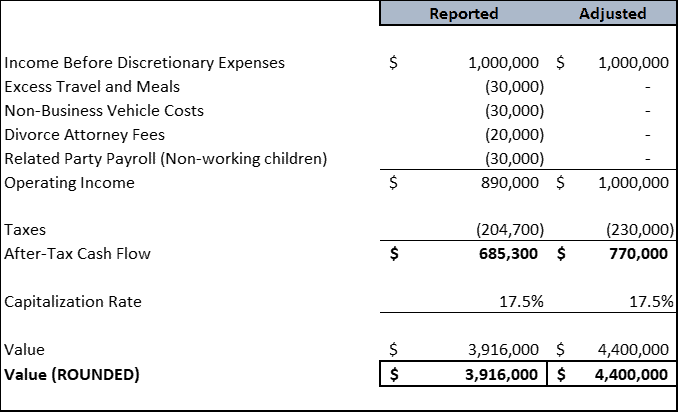

Below is an example of a company that deducted non-essential expenses on their financials and tax returns. If these expenses are not added back to income, the value of the business is artificially lower as the expenses are really benefits to the owner and should increase cash flow:

Valuable Insights

Navigating a business valuation during a divorce requires a thorough understanding of financial intricacies and careful attention to unique business-specific factors. Each element plays a critical role in preparing a credible valuation, from assessing company-specific risks to adjusting for officer compensation and discretionary expenses.

Our business valuation professionals bring invaluable insights and experience to this process, ensuring that valuations unbiased, balanced, and well-supported by data.

If you’re facing the need for a business valuation due to a divorce, partnering with our team can help you achieve a fair outcome. Their expertise can guide you through complex considerations and accurately reflect your business’s worth.

Contact our team today to discuss how we can help you navigate this complex process with confidence and clarity.