While the pandemic has laid waste to diverse sectors of the economy, the residential construction industry has weathered the initial onslaught of the invisible enemy. Companies in the industry are faring relatively well through the first three quarters of 2020, riding the waves of a strong economy through the first quarter, avoiding the terminal diagnosis of “non-essential” in the second, and benefiting from a restoration to a state of relative normalcy in the third. But how long will this last?

Housing supply shortage persisted in Greater Boston, where 70% of the state’s population resides. Paired with heightened demand driven by ultralow interest rates, this supply shortage has made for an aggressive market. We also saw home improvement projects contribute to a strong summer season. Many had unprecedented amounts of free time due to layoffs, remote working schedules, vacation and travel restrictions and shutdowns of entertainment venues. As if the restlessness wasn’t enough, interest rates were felled to record lows, which led to a rush on refinances. Homeowners invested this newfound time and cheap debt into their homes through improvement projects.

Another factor at play is that housing is widely valued as a commodity – and commodities are commonly used as a hedge against inflation. Trillions in government stimulus funding could lead to violent inflation in the coming days. Couple this with the uncertainty of the stock market and low yields elsewhere, and investors could look to sweep up real estate, making it difficult for prospective homebuyers to find homes at the right price – and as houses get swept up by investors, the pool of demand constituted by wanting homebuyers remains. Other drivers of the optimism based on our informal surveying of the industry include continued expected population growth, the recession-proof nature of many jobs in this part of the northeast and potential Exodus out of densely populated cities as people covet space over location in the age of distancing.

This optimism is somewhat tempered by other unknowns. A resurgence of the coronavirus during the upcoming winter months is a real possibility, which could lead to another round of shutdowns, limitations on crew sizes, and supply chain disruptions. We are already seeing such supply chain disruptions in Q3 in lumber and building materials, leading to inventory shortages and significant price increases. Secondly, some of the jobs lost this year will not be found when the dust finally settles. Massachusetts had the highest unemployment rate in the country as of July 2020 at 16.1%, up from just 2.9% in July 2019 (national unemployment rate in July 2020 was 10.2%). Data shows that this is largely the result of self-induced shutdowns resulting from to the pandemic, not a wounded market, as Massachusetts was performing better than the national average earlier this year with 2.8% unemployment in January 2020 (compared to a national average of 3.6%). We can further see this through review of April unemployment data which shows that the 67% of the 623,000 MA jobs lost that month were limited to three sectors hardest hit by COVID 19: Leisure and Hospitality (215,000) Trade, Transportation and Utilities (115,000) and Education and Health Services (85,000); the remainder was generally scattered, but led by job losses in construction.

This staggering unemployment could lead to disruption in the market in the ensuing months. A percentage of these of unemployed individuals have mortgages in forbearance programs made available under the CARES Act. We are sure to being seeing delinquencies once the forbearance period ends. The Act provided for two protections for homeowners with federally or GSE-backed (Fannie Mae or Freddie Mac) or funded mortgages 1) it prohibits lenders from finalizing a foreclosure judgment or sale prior to December 31, 2020 and 2) it allows for 180 forbearance plus another 180 day extension (360 days total) for those suffering financial hardship from COVID 19. Subsequent delinquencies and bank foreclosures are imminent and will result in a short-term boost to housing supply.

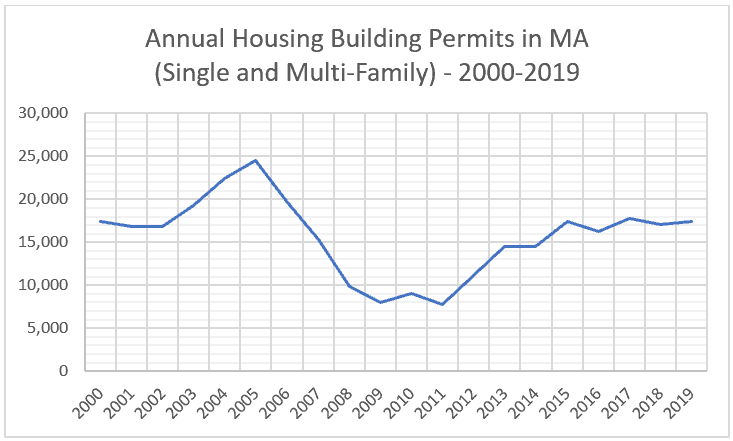

This does not necessarily mean we should expect a repeat of the 2008 recession. For one, there are not as many subprime mortgages out there today and homeowners generally have more equity in their homes, which helps in the event of job loss or an economic downturn. Second, a major driver of housing problems back in 2008 was over-supply, primarily due to a ramp up in production from 2003-2006. Take a moment to look at the total building permits issued in Massachusetts for single and multi-family units over the past 20 years. An average of 15,650 new units have been built annually over that period – while we’ve slightly outpaced that average in recent years, it has not been to the extent of 2003-2006, over which an average of 21,470 units were built annually.

The pace has slowed year over year in 2020 – 7,481 permits have been issued YTD through June, which is tracking 12% behind 2019 over that same six-month stretch (YTD June 2019 totaled 8,499). A deeper look into the 2020 data shows that building pace in 2020 has fallen behind 2019 due to a reduction in multi-unit projects (5,611 through June 2019, compared to 4,609 through June 2020 – an 18% decrease). Single-family building permits YTD through June 2020 are only down 1% year over year. This recent data could suggest that an already constrained supply is not quite being alleviated.

These are only a few drivers of the supply/demand dynamic in the residential world, and there are undoubtedly other factors which could impact the market. If you operate in the construction space, it is imperative that you watch things closely in the months ahead. Tensions are high locally and nationwide; you can feel the undercurrent, the instability. The variables are sensitive – rate hikes could kill demand; and any hint of recession could impact buying habits and the fear stirred up by economic uncertainty can be sure to temper consumer appetites. Take the time now to look sharply into your data and monitor individual projects, to identify trends in your winners and losers – having a deeper knowledge of these will allow you to optimize revenues, and to cut out the losers if the market corners you into cost cuts or restructures. Set and monitor KPIs if not presently doing so and take steps to gain command of the financial risk within your business. Markets like these pose unique challenges and at the same time create unique opportunities – take heed lest they pass you by.

For more, talk to the business advisory group at LGA. We are here to accompany you through the labyrinth.

by John Ead, CPA