“That’s what being a boss is. You steer the ship the best way you know. Sometimes it’s smooth. Sometimes you hit the rocks.” – Junior Soprano, The Sopranos

What the last year has taught us is that one must always be prepared for the unexpected. While the global pandemic impacted our professional and personal lives like a “perfect storm”, many challenging events are relatively more cyclical and predictable – such as bank credit cycles. The banking sector historically tracks with general economic conditions. When the economy is relatively strong, the banks have a greater appetite to lend a borrowers tend to present stronger numbers to support their loan requests. As the economy weakens, however, banks may pull back on their lending activities and borrowers may begin to present less robust performance trends. If there is limited credit availability when one needs it the most, the adverse impact of economic downturns can be daunting.

As many of you recall, when the economy is in a downturn, the repercussions can impact both your professional and personal financial worlds. Prepare for the inevitable downturns, much like folks prepare for hurricane season. History has proven that it tends to be more a matter of when the downturn comes versus if the downturn comes. While one cannot predict precisely when a hurricane or downturn may arrive, there are many available leading indicators that offer decent insight.

Some macro questions to consider: ‘Are you concerned about the impact of rising rates on you or your business? Are you less optimistic about the economy than you have been over the past few years? Are you hearing about banks moving borrowers to their “workout groups” for more attentive monitoring due to concerns on repayment of their loans? Are you finding that banks are less aggressive in pursuing lending activities? Are you hearing the banks may be less aggressive in lending to a particular sector such as restaurants, more speculative real estate projects or borrowers with relatively higher debt burdens?’

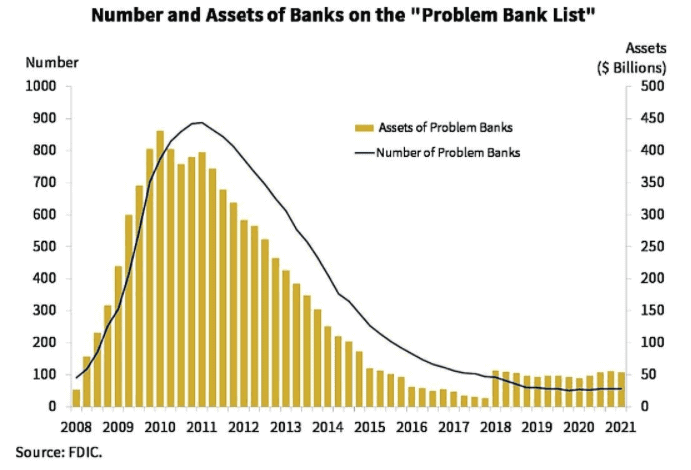

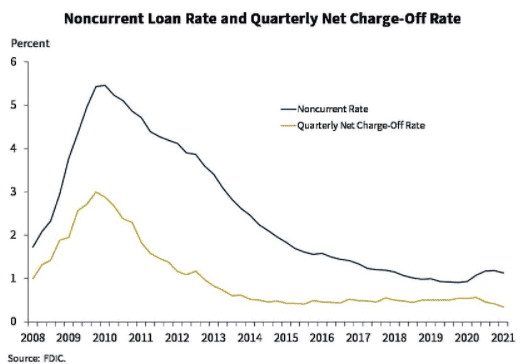

Having advised many banks and companies before, during and after prior downturns, there are a few readily available statistics that merit closer monitoring The FDIC provides a wealth of banking data and future editions of the BAS Market Overview will report updates to 1Q’21 data. Two relevant trends to watch include Noncurrent Loans and Charge-Off’s as well as tracking the FDIC’s Problem Bank list.

“Keep thinking you know everything. Some people are so far behind in a race that they actually think they’re leading.” – Junior Soprano, The Sopranos

What does that mean?

The Noncurrent Loans Rate simply means the percentage of the bank industry’s loans that are not paying the banks in a timely manner. A rising percentage suggests a deterioration in the quality of banks’ loan portfolios. The Net Charge-Off Rate simply means the percentage of the bank industry’s loan portfolio that banks have deemed uncollectable and have been written off. It is important to note that the banks have some level of discretion in determining when a noncurrent loan is written off.

“You even know what your EBITDA is?! Earnings before interest, taxes, depreciation and amortization. Give the true picture of a company’s profitability.” Paulie Walnuts, The Sopranos

What is one to do?

✔️ Be ever vigilant in tracking your company’s day to day risk position.

✔️ Develop forecasts that empower your company to proactively address a full range of what-if scenarios.

✔️Ensure that your company has access to multiple debt and equity sources so that you are prepared for a day if your go-to sources are not there when you need them the most.

LGA’s Business Advisory Services advises companies throughout their lifecycle to ensure that they are empowered to play offense, optimize value and are prepared for an exit at any time – whether it be planned or unsolicited. We help ensure that a company’s capitalization evolves as its company matures, with an eye towards minimizing founder dilution and providing confidence that terms are “market”. Through our investment banking services, we help fill debt and equity gaps as needed throughout their journey.

For further information, please contact:

Ken Segal, Partner, Managing Director of Business Advisory Services KSegal@LGA.cpa

All securities transactions are completed through Avalon Securities, Ltd., a U.S.-registered brker dealer and member of FINRA and SIPC

DISCLAIMER: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Avalon Securities, Ltd. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.