OUR INSIGHTS

Blog

Is Your Business Prepared for Battle? – BAS Market Insight

Blog

2022 Tax Planning: Preparing Your Business for Tax Season

Blog

How to Qualify for the Electric Vehicle Tax Credit

Blog

Is an ARM Mortgage ever a good idea?

Blog

Top Tax Planning Considerations for Construction Companies

Blog

Massachusetts Voters Approve “Millionaire’s Tax”

Blog

Fight, Flight, or Freeze, How will you Respond? – BAS Market Insight Volume 4

Blog

Cryptocurrency Part II: Additional Tax Implications & Considerations

Blog

Employee Benefit Audits – Lessons Learned from Seasoned Professionals

Blog

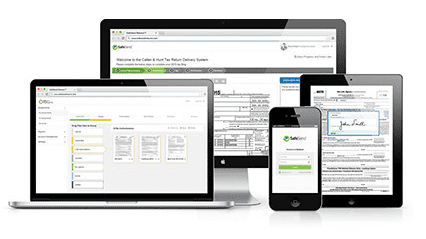

SafeSend Returns FAQ

Blog

Best Practices Part VI | Exit Planning: Positioning for a Sale or Transfer

Blog

Tax Implications for Resident Alien vs Nonresident Alien Status

Disclaimer:

The materials provided in the Insights section are for general informational purposes only and may not reflect the most current legal, tax, or financial developments. While we strive to ensure accuracy at the time of publication, LGA does not guarantee that the information remains up-to-date or free from error. We recommend consulting directly with an LGA team member to confirm the applicability and relevance of any information to your specific situation.